Taking out a 0% balance transfer credit card could cut your interest costs dramatically, allowing you to pay off your debt more quickly.

With most credit card providers charging typical APRs of up to 19%, owing even a modest amount on your plastic could cost a significant sum in the long run. If you have existing debts – particularly on credit cards – these are likely to be an expensive drain on your budget.

The tips below will help you stay on track with your financial goals. Once your budget's in place, it's sadly quite easy to lose track of it and switch back to autopilot.

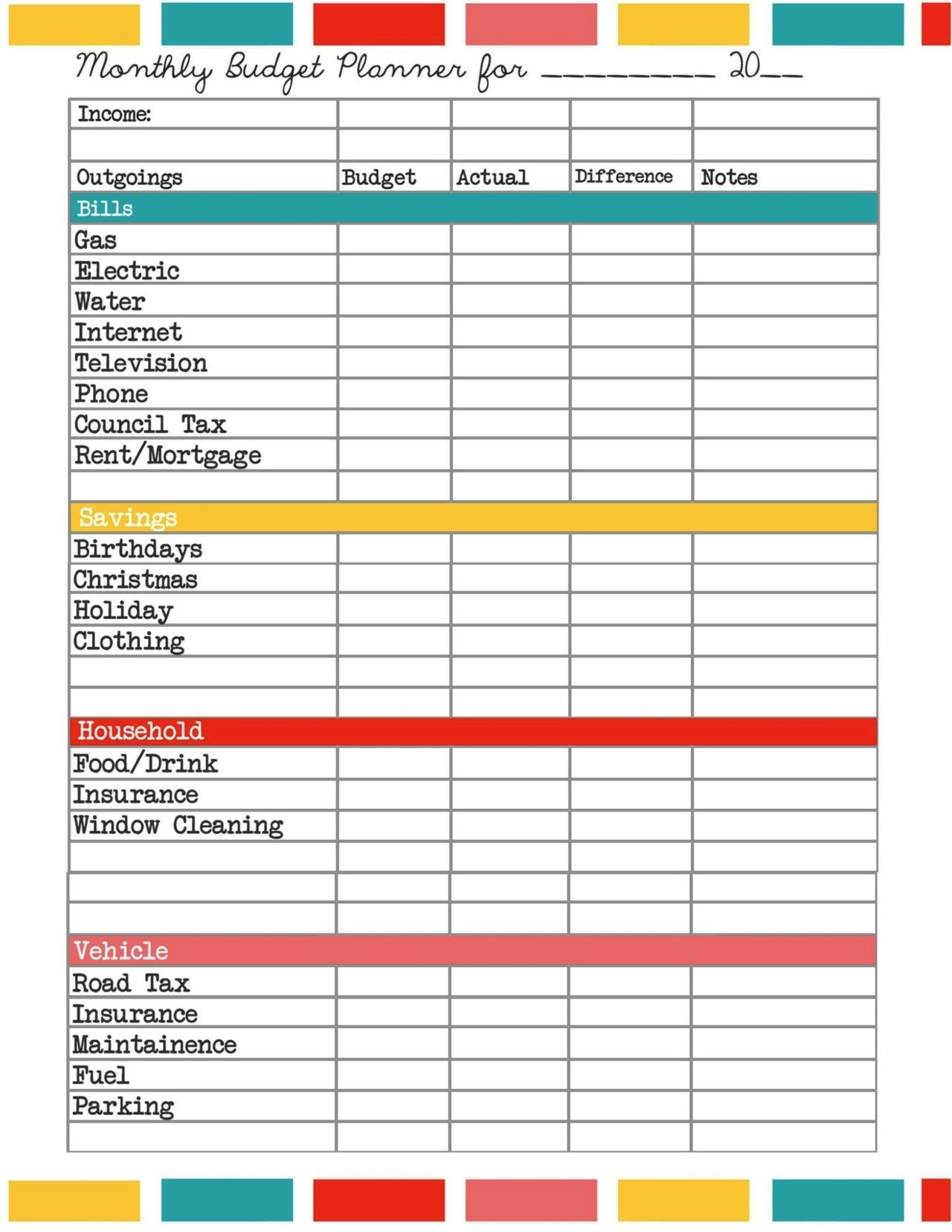

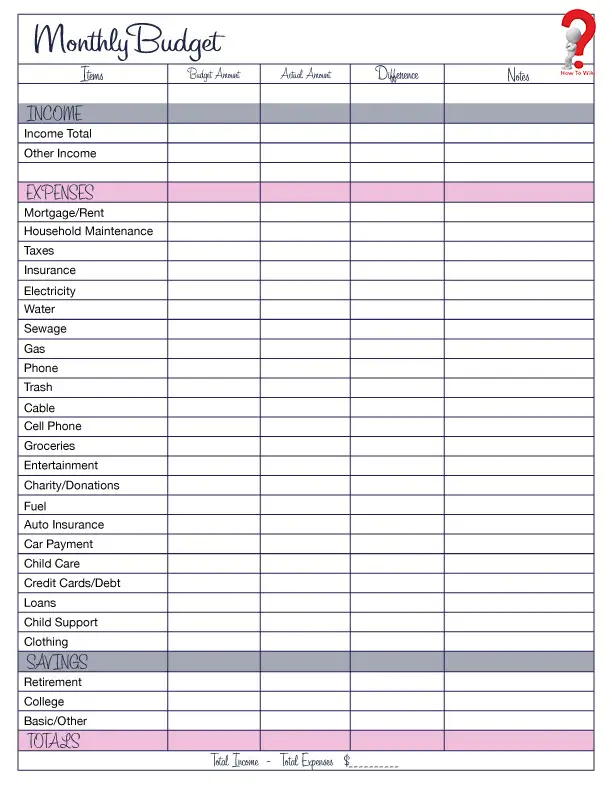

#Monthly household budget template how to

Tip: you can keep up with the latest best rates on savings in our guide to how to find the best savings account. Budgeting is about being prepared for things like this, not just maximising your disposable income. It might be tempting to reduce the amount you're putting into savings, but that money will be important if you ever face an unexpected expense such as a home repair or increased bill. In the example above, our budgeter reduced their spending on alcohol, leisure and 'other' to keep their outgoings below their income. It involves spending 50% of your income on essentials, 30% on leisure/non-essentials, and putting 20% in savings. Many people find using the 50/30/20 rule helpful. You might want to try using a budgeting 'rule' at this point. Use your average earnings and compulsory spending figures for the past three months to estimate how much disposable income you’ll have in future months, adding in any one-off payments you know are on the way.įrom there, you can set a reasonable budget for your disposable income, along with achievable savings targets. With an accurate picture of your average spending now at your fingertips, it should be easy to draw up a monthly budget you can stick to. Tip: at this point, you may discover you’re regularly spending more than you earn. Our guide to paying off your debts could prove useful in this scenario. If you put money into savings, note down how much money you store away each month too. Note how you’ve spent your disposable income in the previous three months. Next, it's time to add a layer that looks at how you spend your disposable income.Īn accurate review of how you’ve previously spent your disposable income will prevent you from under or over-budgeting in certain areas. This will show you how much is typically left for ‘non-essential’ spending each month which will form your disposable income.

The more accurate your figures are, the more useful your budget will be.Ĭalculate your total expenditure for each of the past three months and subtract this from your monthly earnings. Look at your bank statements, household bills and credit card bills for this task. We’ve included multiple forms of income just to show how that would work, but you may well just need to include your monthly salary here (which would be much easier). Here’s our example of the ‘income’ section of a budget. If your main income arrives more frequently, you may prefer to make a weekly or fortnightly budget. In the example below, our budgeter is paid a monthly salary and they do occasional freelance work on the side. information on any other income you may have.Ī lot of this 'paperwork' will be virtual these days, so it might be best to open up several tabs and emails on your phone or laptop or print things out if you think it'll help you.details of your savings and pension contributions.a few months' worth of bank statements.

It's a good idea to gather all the paperwork you’ll need before getting started, so get hold of: Set aside at least an hour to create your budget. Follow the five tips below if you've never budgeted before, or if you're just looking for a financial fresh start.

0 kommentar(er)

0 kommentar(er)